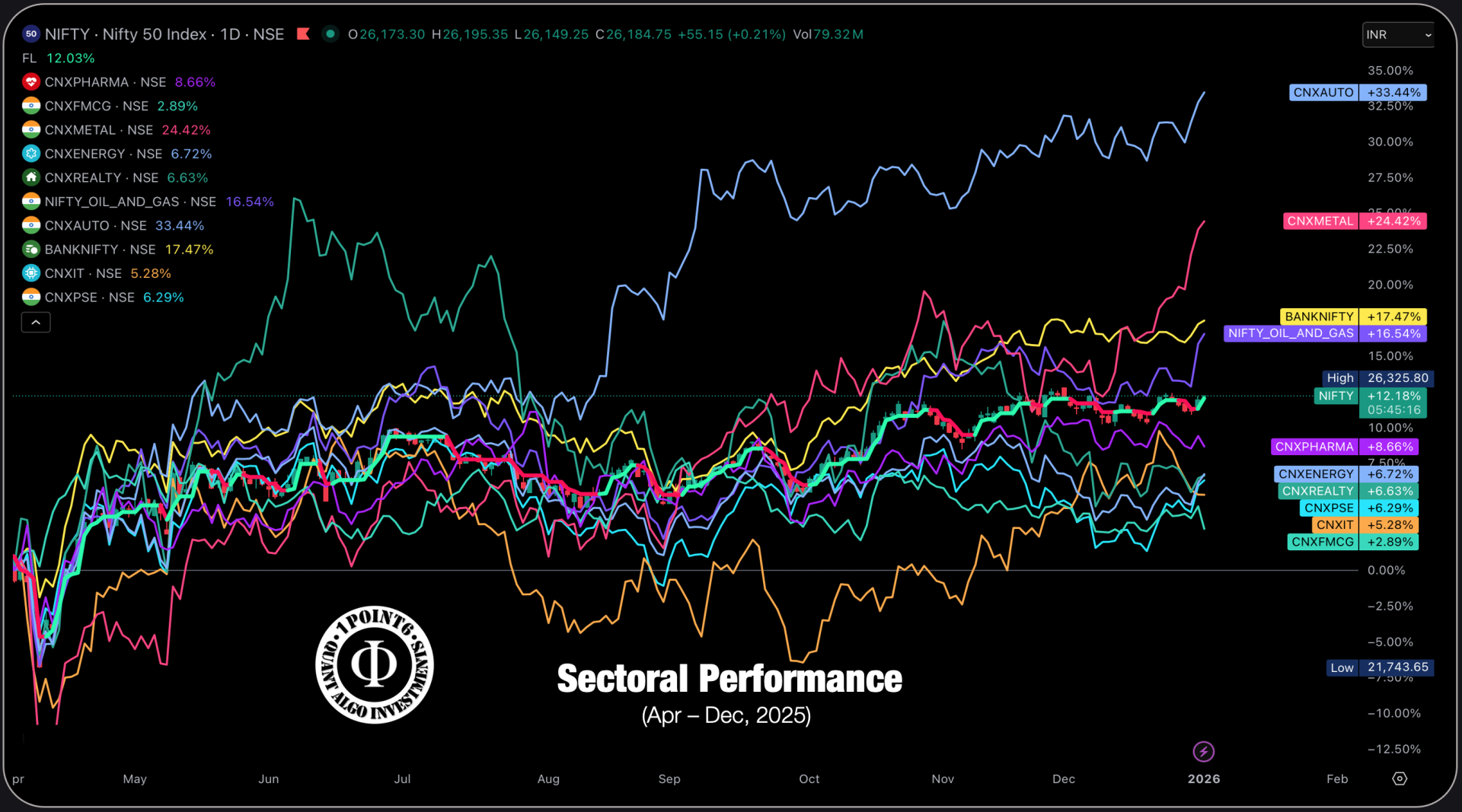

🇮🇳 INDIA SECTORAL PERFORMANCE ANALYSIS

Period: 01 April 2025 → 31 December 2025

1. Executive Summary

From 01 April 2025 to the present, Indian equity markets have displayed clear sectoral divergence, with leadership concentrated in select cyclical and domestic-demand-driven indices. While the benchmark NIFTY 50 delivered a +12.18% return, several sectors meaningfully outperformed, reflecting institutional rotation rather than broad-based market participation.

The period was characterised by:

- Strong domestic growth themes

- Preference for balance-sheet strength

- Gradual exit from export-dependent and defensive sectors

This report evaluates relative performance, structural drivers, policy influences, and future outlook for major Indian sectoral indices.

2. Benchmark Context: NIFTY 50

Performance: +12.18%

The benchmark index served as a stable anchor, moving in a controlled upward trajectory with phases of consolidation. Gains were largely driven by select heavyweight sectors, while many constituents remained range-bound.

Key Interpretation:

Index-level returns understated the opportunity set available through sector selection and rotation.

3. Sector-wise Detailed Analysis

3.1 Auto Index — Market Leader

Performance: +33.44%

Structural Observations

- Strong and sustained uptrend throughout the period

- Minimal drawdowns during broader market corrections

- Clear relative strength versus the benchmark

Key Drivers

- Robust domestic consumption

- Pricing power and operating leverage

- EV transition optimism

- Strong balance sheets and cash flows

Regulatory / Industry Factors

- Supportive policy environment for manufacturing

- Incentives for localisation and EV adoption

Outlook

- Structurally bullish

- Likely to remain a leadership sector, though near-term consolidation may occur after sharp gains

3.2 Metal Index — High Beta Cyclical Outperformance

Performance: +24.42%

Structural Observations

- Volatile but directional uptrend

- Sharp momentum acceleration post mid-year

Key Drivers

- Infrastructure-led demand

- Improved global commodity pricing

- Operating leverage in metal producers

Regulatory / Industry Factors

- Government infrastructure spending

- Environmental compliance costs (long-term risk)

Outlook

- Positive but cyclical

- Suitable for tactical exposure rather than permanent overweight

3.3 Banking Index — Structural Backbone

Performance: +17.47%

Structural Observations

- Steady, low-volatility uptrend

- Outperformed NIFTY but lagged high-beta sectors

Key Drivers

- Credit growth revival

- Improved asset quality

- Stable net interest margins

- Strong capital adequacy

Regulatory / Industry Factors

- Tight regulatory oversight

- Conservative provisioning norms (positive long-term)

Outlook

- Core portfolio sector

- Likely to compound steadily rather than deliver explosive returns

3.4 Oil & Gas Index — Cyclical Stability

Performance: +16.54%

Structural Observations

- Consistent upward bias with intermittent volatility

- Strong recovery phases aligned with commodity cycles

Key Drivers

- Refining margin stability

- Energy demand growth

- Cash-flow-rich business models

Regulatory / Industry Factors

- Price controls and policy interventions

- Energy transition pressures over the long term

Outlook

- Neutral-to-positive

- Best suited for tactical and income-oriented strategies

3.5 Pharma Index — Defensive Underperformance

Performance: +8.66%

Structural Observations

- Choppy price action

- Failed to sustain breakout momentum

Key Drivers

- Export market pricing pressure

- Regulatory scrutiny

- Reduced defensive demand during risk-on phases

Regulatory / Industry Factors

- Stringent global compliance norms

- High R&D and regulatory costs

Outlook

- Neutral

- Leadership revival requires earnings visibility and regulatory clarity

3.6 Energy Index — Subdued Participation

Performance: +6.72%

Structural Observations

- Range-bound structure

- Limited participation in broader market rallies

Key Drivers

- Capital-intensive balance sheets

- Policy uncertainty

- Selective investor interest

Regulatory / Industry Factors

- Transition to renewable energy

- Policy shifts affecting legacy assets

Outlook

- Stock-specific opportunities likely

- Sector-wide leadership unlikely in the near term

3.7 Information Technology Index — Lagging Sector

Performance: +5.28%

Structural Observations

- Persistent relative weakness

- Failed to participate meaningfully in index upmoves

Key Drivers

- Global tech spending slowdown

- Margin pressure

- Currency normalisation

Regulatory / Industry Factors

- Dependence on overseas demand

- Immigration and compliance regulations abroad

Outlook

- Base-building phase

- Structural recovery contingent on global demand revival

4. Relative Strength & Rotation Insights

Leaders:

Structural Supports:

Laggards:

This dispersion reflects a mid-cycle expansion phase, where capital favours domestic cyclicals and balance-sheet strength over defensives and export-dependent sectors.

5. Forward Sectoral Outlook (12–18 Months)

High Conviction

- Auto

- Select Banking & Financials

Tactical / Cyclical

Watchlist / Base Formation

6. Key Risks to Monitor

- Global growth slowdown impacting cyclicals

- Commodity price volatility

- Policy changes affecting regulated sectors

- External capital flow volatility

At present, these risks are manageable and not trend-altering.

7. Conclusion

Between 01 April 2025 and now, Indian equity markets have rewarded sectoral selection over index exposure. The data clearly indicates that:

Alpha generation during this phase was driven by rotation into domestic growth and cyclical sectors.

Unless there is a material macro or policy shock, this sector-led market structure is likely to persist, making disciplined allocation and rotation strategies critical for long-term investors.